Owning a home has long been a part of the American dream. Having your own slice of real estate indicates you are stable, committed, and responsible.

For most Americans, it’s the largest single purchase they will make and most likely their biggest asset. For all the excitement that comes with a first home, the ultimate dream can turn into a nightmare when unforeseen problems surface before the ink on the mortgage papers dries.

Those who have been down the long road of purchasing a first home can attest to the dozens of hurdles buyers must clear before the keys are handed over. Finding the right neighborhood, making the initial offer, haggling over counter offers, scheduling home inspections, and dealing with renovation contractors is enough to confuse even the most organized person.

We surveyed just under 1,000 people, mainly those who have experienced the negative aspects of first-time homeownership, about their most costly mistakes. Paying attention to their advice might save you a lot of heartache and money if you’re considering buying your own place one day.

The homebuying devil is always in the details.

You’ve spent enough hours on Zillow and other real estate sites to secure a graduate degree in nuclear physics before finding the perfect place. Writing the first mortgage check gave you a sense of empowerment—an emotional high—one never felt the previous five years of sliding the rent check under your landlord’s door. You are the king (or queen) and owner of your own castle. And then you notice the rotten hardwood floors when you peel back the 35-year-old pea-green carpet.

Texting your landlord to schedule the repair is no longer an option. That’s because you are your own landlord. When the floor guy does arrive, it’s only a few short minutes before he breaks the news that a few damaged wood planks are just the beginning of your problem. A leaking pipe running from the upstairs bathtub has caused the drywall to mold and the ground to soften, resulting in the back bedroom sinking ever so slightly into the soft sandy soil. Ouch.

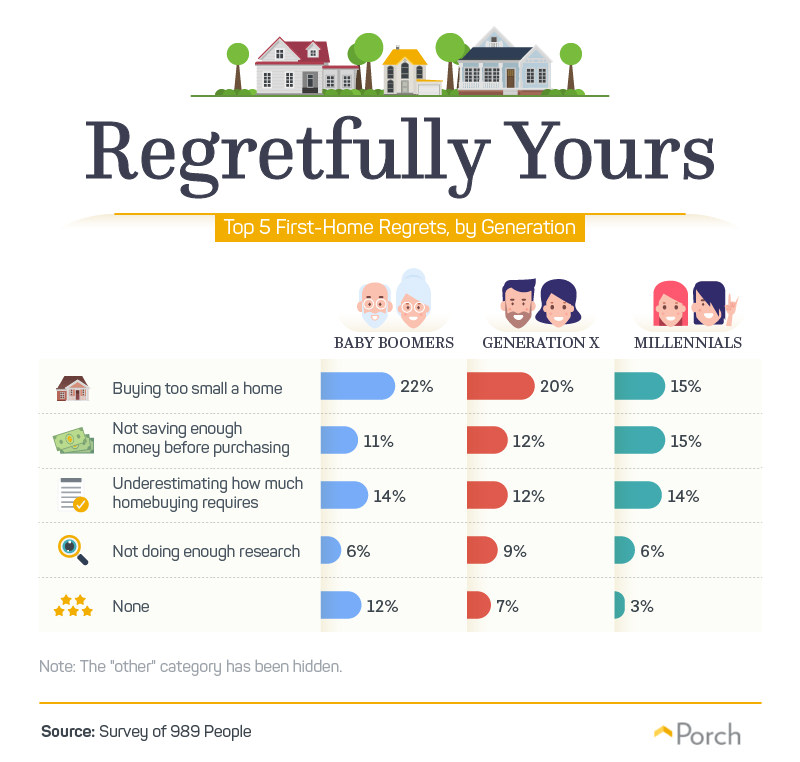

One of the first questions we asked survey participants was their biggest regret after purchasing a first home. Buying something too small was an issue for 22 percent of baby boomers, 20 percent of Gen Xers, and 15 percent of millennials.

By packing your own lunch and declining the previous three long-weekend trips organized by your college roommates, you saved enough of a down payment to qualify for a mortgage. But after the devastating repair news, you have no earthly idea how you’re going to cover the five-figure repair estimate.

That’s why 15 percent of millennials indicated one regret was not saving enough money before making their first-home deal. Along those same lines, 14 percent of both baby boomers and millennials, followed by 12 percent of Gen Xers, said they underestimated how much money owning a home required.

Seeking the advice of a competent and qualified professional contractor or handyman is always a good idea. One of the items they strongly suggest is being present for the final walkthrough to minimize expensive surprises later on.

As one 45-year-old man from Illinois wisely stated, “Attend the home inspection.”

If you would like more information, find an Assist2Sell office near you to connect with an agent.

Assist2Sell

Sell My Home

Buy a Home